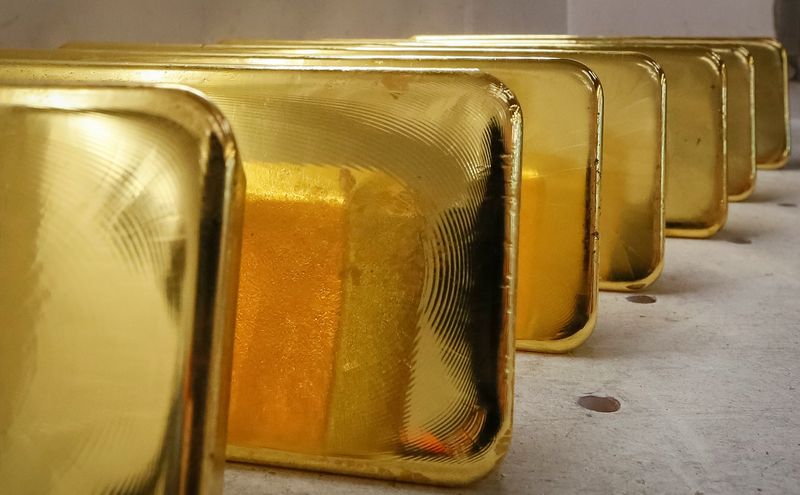

Gold Prices Rise Amid Trump's Tariff Uncertainty

Gold prices have risen due to pressure on the U.S. dollar and the Chinese central bank increasing gold purchases for the second consecutive month. As uncertainty regarding U.S. tariff policies affects the market, investors are focusing on upcoming U.S. labor data.

Spot and futures gold prices have increased, with gold prices rising to $2,660 per ounce today, marking an increase of 1%. Analysts note that the decline in the dollar index is supporting gold prices. As the U.S. dollar weakens, gold continues to benefit from this situation.

The People's Bank of China reportedly raised its gold reserves to 73.29 million fine troy ounces in December. This indicates that the country continues its gold purchases, providing support to gold prices in the markets. Analysts at SP Angel emphasized that China's sustained purchases are boosting investor confidence.

Investors are focused on significant data regarding the U.S. labor market. The labor data to be released this week could provide clues about the Fed's future interest rate policy. The ADP employment report, the labor shortage report, and the Fed's December meeting minutes could increase volatility in gold prices.

Fed Chair Lisa Cook’s comments on the economy's resilience and inflation have signaled delays in interest rate cuts. While gold is generally seen as a hedge against inflation, high interest rates diminish the appeal of this non-yielding asset.

The strong performance of the gold market shows that gold prices have recorded a 27% increase in 2024, supported by central bank purchases and Fed interest rate cuts. Spot silver price rose by 0.8% to $30.19 per ounce, platinum rose by 1.2% to $944.39, and palladium increased by 0.9% to $928.38.

Gold prices are expected to fluctuate this week based on U.S. data, with potential weak economic data increasing the likelihood of the Fed easing its monetary policy. This situation could enhance the allure of non-yielding gold.