USDTRY

On a day when emerging market currencies exhibit varying performances against the US Dollar, the USD/TRY pair is trading with a scenario where the Turkish Lira stands out as the weakest currency (with a 0.30% loss). In contrast, the Thai Baht is recorded as the strongest currency with a 0.41% gain. This divergence causes the Turkish Lira to remain weak against the USD, with the pair trading near the 35.53 level. While mixed trends are observed in the Asian markets, there is an environment where global economic data and US interest rate policy expectations could influence the pair.

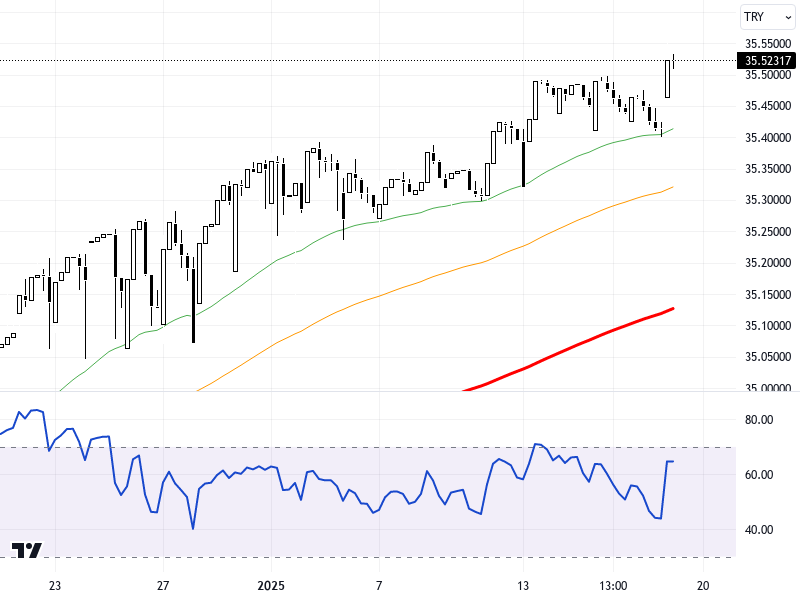

From a technical perspective, the USD/TRY pair maintains its short-term upward trend by staying above the 35.30 support level. This situation may continue with the pair targeting the 35.58 resistance level. In upward movements, the levels of 35.65 and 35.71 can be monitored. The RSI indicator is at 54 and shows a positive trend. The daily change is 0.31%, indicating an upward movement of the pair. However, a consolidation between 35.30 and 35.65 may be observed. If the supports are broken, pullbacks to the 35.30 level may be seen.

Support :

Resistance :