USDTRY

The USD/TRY pair is moving in the light of emerging market dynamics, with the weak performance of the Turkish Lira drawing attention. While other emerging market currencies like the Malaysian Ringgit and Colombian Peso show different performances, the relatively weaker outlook of the Turkish Lira supports the upward trend of the USD/TRY pair. Additionally, significant economic developments such as upcoming PCE inflation data from the US and Fitch's credit rating assessment for Turkey may affect the short-term movements of the pair.

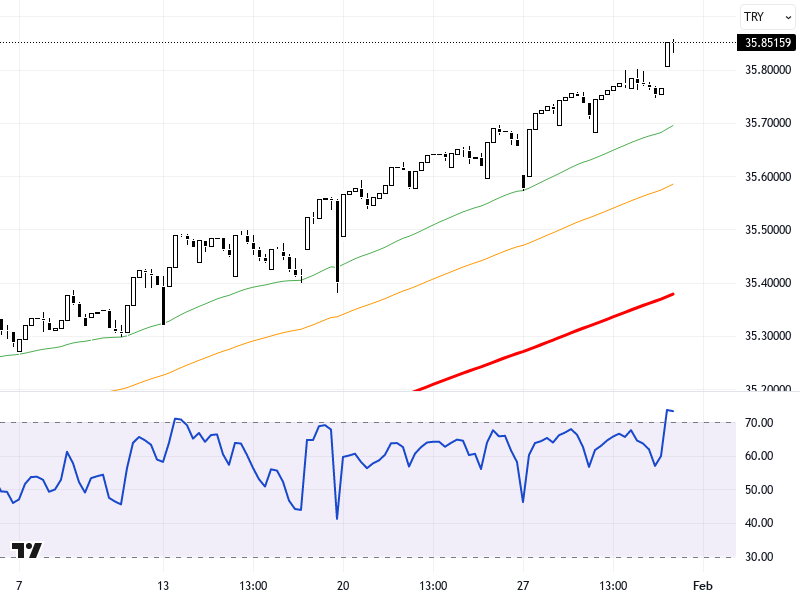

From a technical perspective, while the USD/TRY pair is trading near the resistance level of 35.87, if this level is exceeded, the resistance zones at 35.93 and 35.98 can be monitored. In downward movements, the levels of 35.80, 35.71, and 35.66 are followed as support. The fact that the lower point of the Envelope indicator is at 35.62 indicates that as long as the pair remains above this level, it may maintain its upward trend. The RSI indicator presents a neutral view. The pair has increased by 0.24% compared to the previous day and may experience a squeeze between the support and resistance levels.

Support :

Resistance :